FINANCIAL AID

It is important to Citrus Heights Beauty College to provide superior education at a reasonable and fair tuition rate.

To apply for financial aid, start by creating an FSA ID (Federal Student Aid ID) and logging in. Then, complete the Free Application for Federal Student Aid (FAFSA) form online. After submitting, review the FAFSA submission summary, respond to the aid offer, and receive your financial aid. Remember to apply for financial aid every year. For questions you can contac our Financial Aid Officer at (916) 735-3777

STEPS:

1. Create an FSA ID: A FSA ID is a username and password you’ll use to access your FSA account and submit the FAFSA form. You’ll need your Social Security number, full name, and date of birth to create it.

2. Complete the FAFSA form: The FAFSA is the primary application for federal student aid. It gathers information about your family’s income and assets to determine your eligibility for grants, work-study, and loans. You can find the FAFSA form at fafsa.gov. Add the school by searching for Citrus Heights Beauty College by entering the School Code 014064.

3. Review the FAFSA Submission Summary: After submitting your FAFSA, review the summary to ensure all information is correct.

4. Respond to the Aid Offer: Your financial aid offer from your school will detail the type and amount of aid you’ve been awarded. You’ll need to accept or decline the offer.

1. Receive Aid: Once you’ve accepted your aid, it will be disbursed to your school.

1. Apply Every Year: You need to apply for financial aid each year you are in school.

We do not want the cost of tuition to prevent anyone from achieving their goals in the salon and spa industry.

For questions regarding Consumer Information, Contact our Financial Aid Director at (916) 735-3777

We provide a variety of tuition payment options, including:

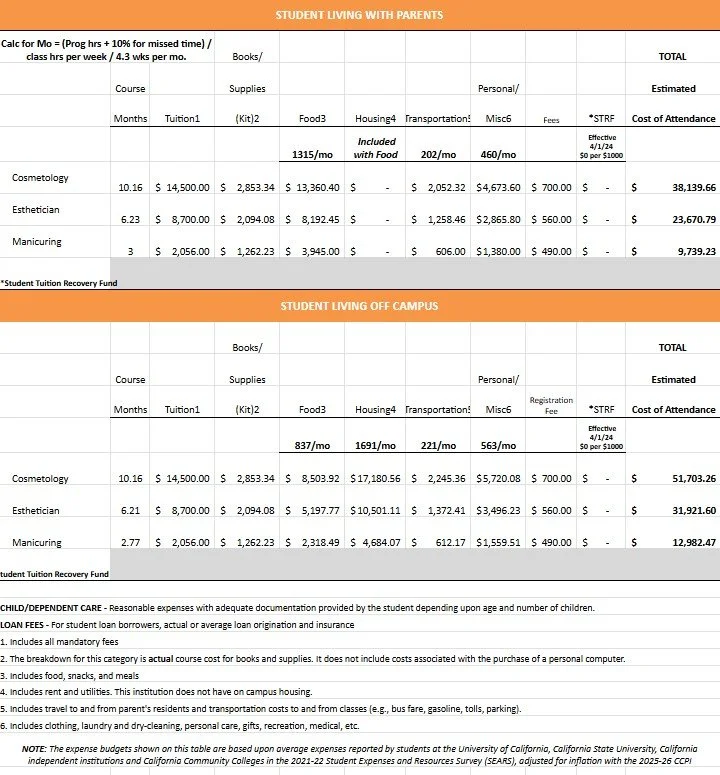

These monthly allowances are multiplied times the number of months in your program and added to your tuition and fees. The number of months may vary depending on whether the student is attending full time or part time.

Information about Types of Financial Aid

Grants

A grant is a form of financial aid that doesn’t have to be repaid (unless, for example, you withdraw from school and owe a refund, or you receive a TEACH Grant and don’t complete your service obligation). A variety of federal grants are available, including:

Pell Grants

Differences Between Direct Subsidized Loans and Direct Unsubsidized Loans

In short, Direct Subsidized Loans have slightly better terms to help out students with financial need.

Quick Overview of Direct Subsidized Loans

Who can get Direct Subsidized Loans?

Direct Subsidized Loans are available to undergraduate students with financial need.

How much can you borrow?

Your school determines the amount you can borrow, and the amount may not exceed your financial need.

Who will pay the interest?

The U.S. Department of Education pays the interest on a Direct Subsidized Loan

while you’re in school at least half-time,

for the first six months after you leave school (referred to as a grace period*), and

during a period of deferment (a postponement of loan payments).

Quick Overview of Direct Unsubsidized Loans

Who can get Direct Unsubsidized Loans?

Direct Unsubsidized Loans are available to undergraduate and graduate students; there is no requirement to demonstrate financial need.

How much can you borrow?

Your school determines the amount you can borrow based on your cost of attendance and other financial aid you receive.

Who will pay the interest?

You are responsible for paying the interest on a Direct Unsubsidized Loan during all periods.

Good to know: During periods of time when you are not required to make payments—such as while you are in school, in a deferment, or in a forbearance—your interest will accrue (accumulate) and it will in certain instances be capitalized (which means that your interest will be added to the principal amount of your loan). Whether your unpaid interest capitalizes or not, you are still responsible for paying the interest that accrues. You can always choose to pay the interest that accrues even when you are not required to make a payment.

Get more information

If you're interested in learning more about Citrus Heights Beauty College's financial aid options and want to learn more, please contact us! We are here to help get you the information you need to begin your career!

Citrus Heights Beauty College is registered with DFPI under the CCFPL. Registration# 03-CCFPL-2694691-3482233

At this time, CHBC does not offer classes for special needs students.

Citrus Heights Beauty College is Accredited by the National Accrediting Commission of Career Arts & Sciences (NACCAS)

*Individual net price estimates are not final, not binding, and may change. Each student must complete the Free Application for Federal Student Aid (FAFSA) to be eligible for and receive Federal Student Aid funds. Information and application regarding Federal Student Aid can be found on https://fafsa.ed.gov

Emergency Broadband Benefit Program

The Federal Communications Commission (FCC) recently announced the Emergency Broadband Benefit Program to provide a temporary discount on monthly broadband bills for qualifying low-income households. The program begins accepting applications on May 12, 2021. Funding is limited, so act quickly to see if you qualify. Click here for more details and eligibility.